The Litmus Test: When To Sell & Upgrade?

- MOPUpgraders Team

- Mar 22, 2020

- 6 min read

Updated: Jan 24, 2024

The Usual Path for Most Singaporeans

In Singapore, most couples have the opportunity to choose to live in subsidised Build-To-Order (BTO) flats or Executive Condominiums (EC). Because BTO / EC are heavily subsidized, it does seem to make sense for owners to sell in the open market at much higher market price and upgrade to condominium.

Upgrading to a condominium is considered a rite of passage for some aspiring Singaporeans. But is it smart or dumb move to sell their property right after MOP or is there actually golden time period to sell it then upgrade without any stress?

When Is The Best Timing to Sell & Upgrade?

I am often being asked by my friends around me the same question during gatherings even though their properties have not yet crossed the 5-year MOP mark. In my honest opinion, there is no true answer to the question above unless one has the ability to predict the future.

Most MOP owners should be bombarded with a lot of promotional flyers, Facebook advertisements etc depicting that they should sell their house as soon as fulfilling the MOP requirement then upgrade.

If you are looking to upgrade to bigger space / better lifestyle, you should not be just looking at selling at 5th year MOP mark:

❌ Just because selling at the 5th year is the peak price possible

❌ Just because your house has the longest balance tenure of 94 years

❌ Just because you have more cash proceed due to incurring the least accrued CPF interest

It is absolutely true that upgrading is not an easy journey. No doubt that you need to squeeze out every cent of your sale to make a more comfortable upgrade. However, you should not just sell just for the sake of selling and should not just follow the herd instinct. It needs not be at the 5th MOP mark if you are not even ready to sell and upgrade. There are a few criteria you as the owners need to consider.

"Today I will be sharing 3 items in the checklist for you to go through for comfortable upgrading"

If you have 3 ticks ✅ at this current moment, it is the best possible time for you to sell your property now and upgrade without stress!

1st Criteria: Appreciation in Price for Existing Property

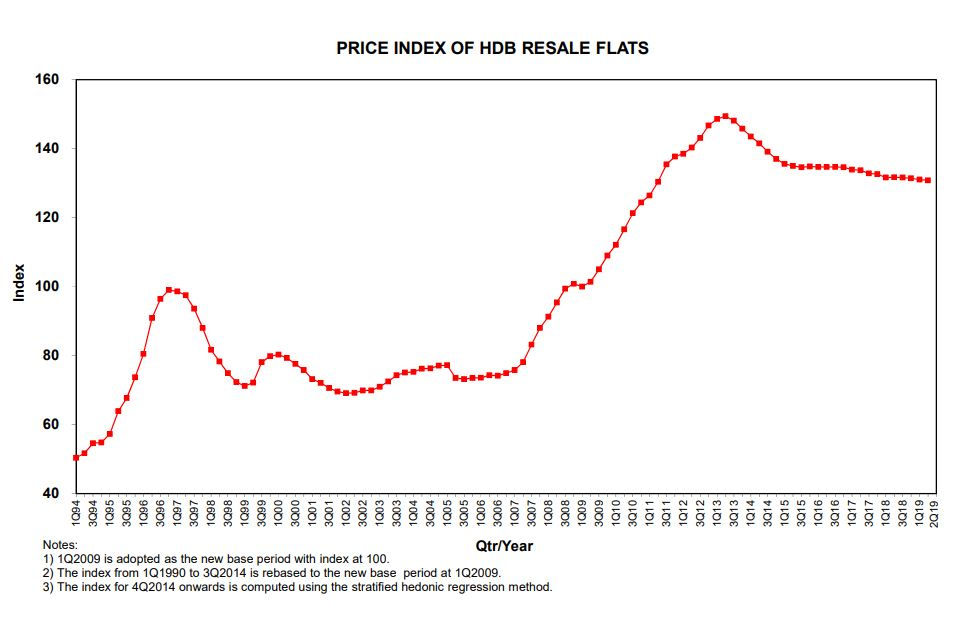

There was appreciation in property price from 2007 to 2012. However from 2013 onward till today, the resale flat appreciation has slowed down and reached a plateau due to various property cooling measures introduced by the Singapore government. With this kind of ongoing trend, it could mean that any BTO purchased from 2012 onward might not experience better growth in the resale prices. The government is also sending the signal to all to not treat HDB flats as long term investment vehicle.

One of the latest measures introduced in March 2014 which is to make house's valuation a guessing game for both buyers and sellers. This measure has made Cash-Over-Valuation a thing in the past. COV was no longer being used in negotiation under this new resale procedure. This move has caused the property price to be stablisized and be kept controlled under the government's radar.

Not forgetting the pump up supplies of of BTO projects every year, new BTO blocks are springing up in hundreds and many will reach MOP at the same period of time. With huge supply of flats for limited pool of buyers, there will be downward pressure on the selling price of your MOP fulfilled property. Therefore you should do your sums meticulously and observe market condition carefully once your unit has met the MOP criteria. You need not sell at the 5th year mark if the price is not ready at your expectation to upgrade.

If your property has appreciated significantly, you got one ✅ off the checklist to upgrade comfortably!

Criteria 2: Affordability In Upgrading To Next Property

Upgrading to private property requires a certain degree of financial strength and it is necessary to check whether one can afford to proceed with the plan. It is essential that you do have all the numbers at your fingertips in order to make sure you do not burn a hole in your pocket. Aspiring upgraders should always have some backup plan or savings to buffer for uncertainty or unemployment for a few months, so that they are not overburdened by higher mortgage installment after the upgrade had taken place.

One need to study carefully on the upgrade options (EA, EM, EC, new launch or resale condo) because each property type behaves differently. If you are purchasing EA / EM for its luxury of space, you will need to study their balance lease to determine their market price as most of them are situated at matured estates. If you intend to purchase new launch or EC, you will need to observe the supply pipeline in your preferred region and secure the best possible price from developer. For you to purchase resale condo as your next upgrade home, you will need to see how has the development progressed over the years in the transaction record and to see if there is growth potential.

If you have made up your mind which upgrade option to go for and you have done your homework that you are able to afford it, you got one more ✅ off the checklist to go ahead to upgrade without stress!

Criteria 3: Mental Preparedness To Make The Switch

Aspiring upgraders sometimes will be caught off guard in many situations after they have made the move to upgrade and switch to either EA / EM or EC / new launch / resale condo. Living in new launch or resale condo means trading up in value but down in size. You should expect to pay higher property tax and higher condo maintenance fees of about $300 to $500 per quarter depending on your unit share value. Each project development has its own condo management with different rules and regulations. You can attend annual General Meetings or Council Meetings throughout the year to propose motions or cast vote to pass / against certain motions.

Not doubt EA / EM's conservancy charges are very minimal with just less than $80 every month, HDB upgraders may face situations when the house may become too big to manage unless mobilising all family members to do housework or engaging helpers to manage the house chores. Maintenance expenses unexpectedly will be higher for EA / EM such big houses which range from 1300 sqft to 1600 sqft. As you are buying EA / EM at matured estate, you should be mentality prepared that the appreciation in value may not be sustainable with decrease in balance lease. However, there will always be demand for EA / EM as they are giant in size and very rare in the resale HDB market.

If you have adjusted your expectations towards the new environment that you are going to upgrade to, you got one extra ✅ off the checklist to sell your MOP fulfilled house and upgrade to your choice property.

BEST OPTIMAL TIMING: AFTER MOP

Despite saying all the above, the optimal timing should be right after MOP.

I have seen significant depreciation of property values for those crossing the 10 years mark. The peak prices are usually when reaching the 5-year MOP mark. Reason being MOP units are highly sought after by buyers who looking for renovated units to move in immediately.

Let's look at 2 case studies:

1st case study: 2 different HDB units at similar floor level #04-#06 and floor area located in Punggol Place area. One premium apartment with size 110 sqm in block 296 Punggol Place (known as House A) whereas another unit with size 116 sqm in block 288A Punggol Place (known as House B) both were sold around the same period between April to May 2019.

House A with balance lease 83 years was sold at $454000) whereas House B with balance lease 93 years was sold at $635000. The price difference is almost near to $200000. This shows the premium that buyers are willing to pay for newer flat especially those just meet MOP at 5th year mark.

2nd case study: 2 transacted HDB units at similar floor level #07-#09 and floor area located in Punggol Place area. One premium apartment with size 110 sqm in block 294 Punggol Place (known as House C) whereas another unit with size 112 sqm in block 289D Punggol Place (known as House D) both were sold around the same month October.

House C with balance lease 84 years was sold at $468888) whereas House D with balance lease 93 years was sold at $677000. Again The price is 44% difference with just 10 years difference in tenure. This shows that a newer property can retain its value better. Holding on to your property beyond 10 years might not be wise especially if you plan to extract the most value to go for comfortable upgrade.

We need to understand that all of us have our ambitions and limitations. Upgrading is the dream of many but should be done only when one’s situation and finances has been assessed. Hence, there is no one size fits all that we can refer to. There is no precise answer to be given to you when is the best time to sell your property and upgrade without overstretching yourself.

We understand that financial planning can be a daunting task, and we're here to simplify it for you speak with us.

If you have a plan in mind but not sure if it works well – do share with us or let us know.

We will do our best to assist you to make sure you look at your plan from multiple angles and ensure you have a very clear picture on what’s going on.

Comments